I went in on GREK on Friday, puts, despite a massive move in my direction, the put price barely moved :/ This seems to happen a lot to me, and I haven't figured it out yet.

Monday, January 30, 2017

This level looks important / SPX

I went in on GREK on Friday, puts, despite a massive move in my direction, the put price barely moved :/ This seems to happen a lot to me, and I haven't figured it out yet.

Wednesday, January 25, 2017

The Dow and the Road to Roota

I've got a sneaking suspicion that the game is changing.

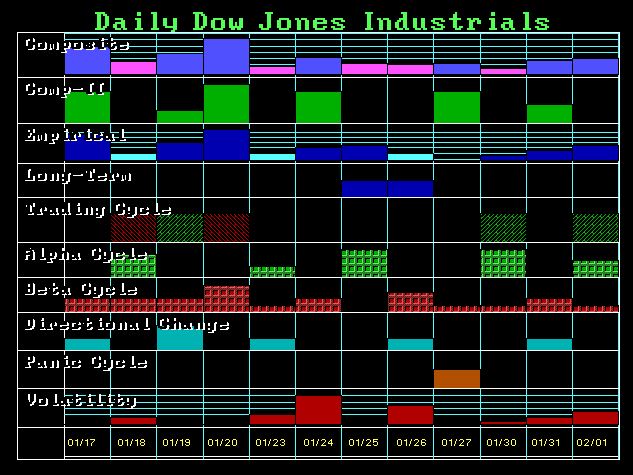

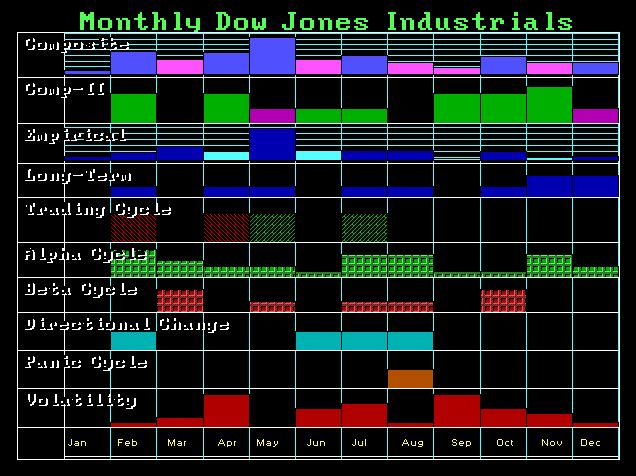

While this doesn't mean that much by itself, the recent daily timing array seems uncorrelated to reality.

What's really playing out seems to be the Bix Weir version. He was very accurate about the election and the Deutsche bank situation last year.

As per Bix Weir's version of conspiracy, "The Road to Roota"

The Bad guys were flying high last year, with everything rigged for a Hillary election. They beat the FBI already (the first time). Hillary was up like 15 points.

There was the wikileaks factor, but it appeared that Hillary got the best of them. Later Assange was taken out, at the same time as twitter to prevent him from getting a message out. To this day I'm not sure he's back, but it does appear to be the case, thankfully for him.

Then Tragedy struck as Comey (hero) got a hold of Weiner's laptop will the dirtiest of the dirt on Hillary. The polls tanked as the rigged system didn't know what was going to happen. The FBI believed her to be "Devil Incarnate" they say. After a week of browsing the laptop, the FBI was prepared to go on a raid the Saturday before the election.

Instead that didn't happen, and on Sunday they announce they got nothing. It was the sign that a deal had been struck, and Hillary switched the rig to Trump and now she's off the hook, with Trump even saying as much.

Long story short - the good guys took over.

With that, it may be time to end the manipulation. Dow hits 20K today. If this is the all time high I won't be surprised, however as you know, this could end in hyperinflation that doesn't see stocks fall at all (but rise less than metals or bitcoin)

Having said that, it's not necessary to jump in short right now. I considered it yesterday, which would have been a mistake. If it closes down today then I'm pretty sure it's over.

In Bo Polny theory, the dow would hit 20K then crash. He backed off that, satisfied with 19999.67 rounded, and thought yesterday that the high was in place and it would crash through Feb 15. Today is not doing that any favors, but maybe they rigged a 20K day first? So I'm going to wait another day to see what happens.

Armstrong says a close over 20012 means we will get to 23000.

Mannarino is expecting a sustained Trump rally.

EDIT- I just reviewed Polny and he says Jan 13th was the maximum time point for a new high. Most of his dates lately have been Fridays, so I'm going to pay attention to see if the Friday close is back down below the past weekly closes.

While this doesn't mean that much by itself, the recent daily timing array seems uncorrelated to reality.

What's really playing out seems to be the Bix Weir version. He was very accurate about the election and the Deutsche bank situation last year.

As per Bix Weir's version of conspiracy, "The Road to Roota"

The Bad guys were flying high last year, with everything rigged for a Hillary election. They beat the FBI already (the first time). Hillary was up like 15 points.

There was the wikileaks factor, but it appeared that Hillary got the best of them. Later Assange was taken out, at the same time as twitter to prevent him from getting a message out. To this day I'm not sure he's back, but it does appear to be the case, thankfully for him.

Then Tragedy struck as Comey (hero) got a hold of Weiner's laptop will the dirtiest of the dirt on Hillary. The polls tanked as the rigged system didn't know what was going to happen. The FBI believed her to be "Devil Incarnate" they say. After a week of browsing the laptop, the FBI was prepared to go on a raid the Saturday before the election.

Instead that didn't happen, and on Sunday they announce they got nothing. It was the sign that a deal had been struck, and Hillary switched the rig to Trump and now she's off the hook, with Trump even saying as much.

Long story short - the good guys took over.

With that, it may be time to end the manipulation. Dow hits 20K today. If this is the all time high I won't be surprised, however as you know, this could end in hyperinflation that doesn't see stocks fall at all (but rise less than metals or bitcoin)

Having said that, it's not necessary to jump in short right now. I considered it yesterday, which would have been a mistake. If it closes down today then I'm pretty sure it's over.

In Bo Polny theory, the dow would hit 20K then crash. He backed off that, satisfied with 19999.67 rounded, and thought yesterday that the high was in place and it would crash through Feb 15. Today is not doing that any favors, but maybe they rigged a 20K day first? So I'm going to wait another day to see what happens.

Armstrong says a close over 20012 means we will get to 23000.

Mannarino is expecting a sustained Trump rally.

EDIT- I just reviewed Polny and he says Jan 13th was the maximum time point for a new high. Most of his dates lately have been Fridays, so I'm going to pay attention to see if the Friday close is back down below the past weekly closes.

Thursday, January 19, 2017

Trades I'm considering right now

With Jan 20th seemingly a intergalactic nexus of importance:

Martin Armstrong predicts a gold high this week, so I'm considering this, far out of the money incase it goes against me, I'll mostly just be out commissions.

At the same time, I'm also considering gold longs also far out of the money based mostly on Polny or the generally idea of manipulation/rigging coming to a close.

I'm short GS with options expiring Friday. I went 3 clicks into the money such that there was essentially no cost to hold. It requires more money down this way. This short is based mostly off of John Howells advice.

I will probably go long in general after tomorrow based off the daily array. Either SPX or maybe Mannarino's picks or maybe I will go digging for my own signals. Several of Mannarino's longs look like they are at weekly peaks and look bad for this reason.

Martin Armstrong predicts a gold high this week, so I'm considering this, far out of the money incase it goes against me, I'll mostly just be out commissions.

At the same time, I'm also considering gold longs also far out of the money based mostly on Polny or the generally idea of manipulation/rigging coming to a close.

I'm short GS with options expiring Friday. I went 3 clicks into the money such that there was essentially no cost to hold. It requires more money down this way. This short is based mostly off of John Howells advice.

I will probably go long in general after tomorrow based off the daily array. Either SPX or maybe Mannarino's picks or maybe I will go digging for my own signals. Several of Mannarino's longs look like they are at weekly peaks and look bad for this reason.

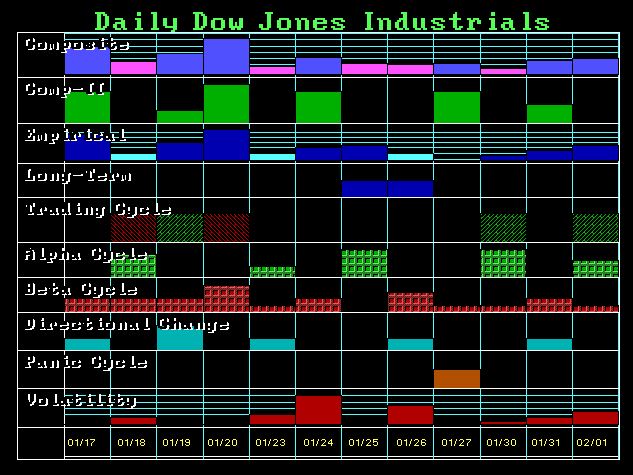

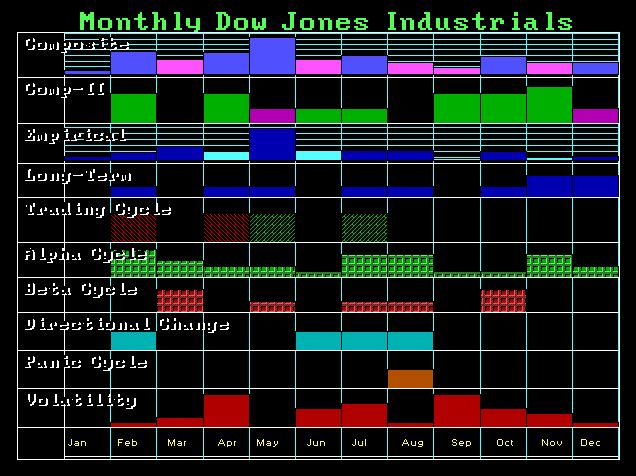

Friday Turning Point Dow Array

I think this will be a good one. The following is directly from Armstrong economics

It is interesting how the computer has picked up the 20th as an important date from the cycles rather than fundamentals.

We still see February as a Directional Change and volatility should rise into the April/May time frame overall in many markets.

---------------------------

So perhaps there has been some trepidation with the upcoming inauguration. We've had a number of consecutive lower days. Once we get past the inauguration there may be a lift off / new all time high?

The monthly trend has been up, so Feb might mark a turning point for the lower. This February Monthly bar has been showing up for a long time and hasn't changed, although now it's a bit smaller.

Whatever happens in May looks major.

It is interesting how the computer has picked up the 20th as an important date from the cycles rather than fundamentals.

We still see February as a Directional Change and volatility should rise into the April/May time frame overall in many markets.

---------------------------

So perhaps there has been some trepidation with the upcoming inauguration. We've had a number of consecutive lower days. Once we get past the inauguration there may be a lift off / new all time high?

The monthly trend has been up, so Feb might mark a turning point for the lower. This February Monthly bar has been showing up for a long time and hasn't changed, although now it's a bit smaller.

Whatever happens in May looks major.

A Caveat to Evolution

No image needed, just make sure you check the weekly chart so that it's not at a peak (if you are buying a long). The weekly chart typically has very nice peaks and valleys. I wouldn't go against that trend.

So a possible usage of evolution, look for the signals on the daily, and confirm it by weekly price action, and then use the 30 minute chart for the within-day timing.

So a possible usage of evolution, look for the signals on the daily, and confirm it by weekly price action, and then use the 30 minute chart for the within-day timing.

Tuesday, January 17, 2017

Dow

12/19 in hindsight looks like a turning point low week, followed by 1/2/17 which was a high. The next week closed lower and this current week is lower so far, and not a turning point yet. Maybe it will turn pack up next week.

So with chaos expected Friday, this could take a dive and hit support in the week beginning 1/23? Our evolution tools say sell right now

I really don't know where you can draw any nearby support right now other than this horizontal green bar. So I suppose I'll wait for that to either break or the new all time high and play it to continue.

The space between the green lines is about 600 points. So if it breaks new all time highs I will go long, if it breaks this first green line I'll play it to make the second one.

What to be ready for in Gold

This post is going to be Armstrong-centric

At the moment we have hit roughly the 1218 line and ebbed slightly. This could be the high for the time being. Armstrong: "Our timing models had targeted this week of the 16th for a turning point. We have been warning for months that January would be a key timing target. Gold tends to be very seasonal and January is often the time for highs and lows on a major scale... Be an guard for a high this week"

So this could be set up. I think I will wait for a sell signal on evolution.

The real question is, will it take out the previous low (bearish) or form a higher low (bullish). I recommend finding some John Howell talking about gold charts on youtube.

I think gold could be wild either way, so I'll be staying "out of the money", less max risk this way.

For the price target, I think this is at least 113 on the GLD if it makes a higher low, and much lower if not. Another possible target is 110.4 or taking out the previous low entirely if it stays bearish.

The other thing to watch out for is Friday. I'm expecting at least moderate chaos during the inauguration. Other than for the reason of "why not?" I do have some evidence on this. Is chaos bullish for gold? Honestly it's hard to say what's bullish for gold.

I might diversify this with some puts on FXE. It's gone up a lot and I think remains in a bear market.

One final image

This his a quarterly gold turning point for 3rd correctly. So it seems to suggest that we are not turning at the moment.

Friday, January 13, 2017

DJIA before the close for the upcoming weeks

While I could put more into this post, there isn't enough time. So I'm coming at you with the basics.

A lot of people are out there saying the Dow is about to make a big move one way or the other, based on the current compression. I contend there is sufficient evidence to think it will go in the general direction of down.

Way overbought on the UO, and actually this is a sell signal on the weekly chart. I probably won't do anything myself until Tuesday because weekends scare me.

Also, recall the timing array from Armstrong economics.

After the week of 1/02 was a high, this week finished down and is not a turning point week.

Other stuff I don't have time to do properly, last quarter was a big turning point quarter, so that might be significant.

The next major turning point month is Febuary.

All of this is based on my opinions only!

A lot of people are out there saying the Dow is about to make a big move one way or the other, based on the current compression. I contend there is sufficient evidence to think it will go in the general direction of down.

Way overbought on the UO, and actually this is a sell signal on the weekly chart. I probably won't do anything myself until Tuesday because weekends scare me.

After the week of 1/02 was a high, this week finished down and is not a turning point week.

Other stuff I don't have time to do properly, last quarter was a big turning point quarter, so that might be significant.

The next major turning point month is Febuary.

All of this is based on my opinions only!

Subscribe to:

Posts (Atom)